service tax new mexico

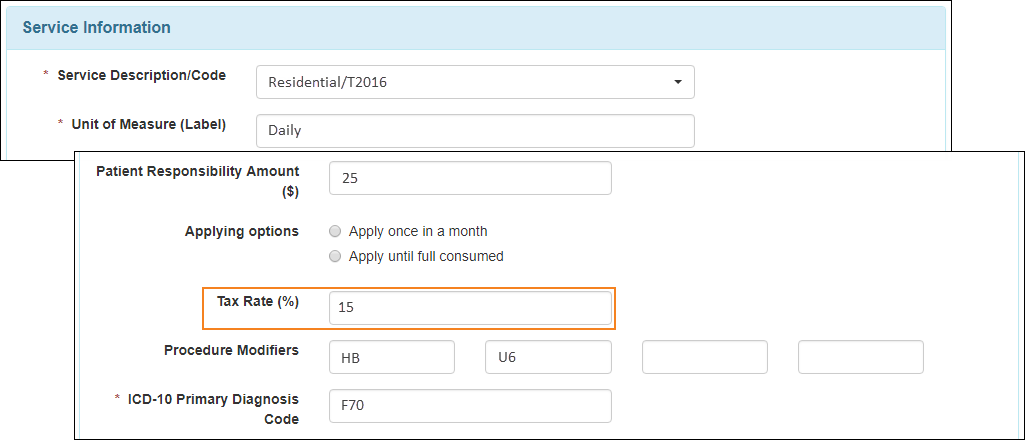

This tax is imposed on persons engaged in business in New Mexico. New forms to provide.

How To File And Pay Sales Tax In New Mexico Taxvalet

While New Mexicos sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

. Remainder of County 80625 Percent. As of 7121 New Mexico is considered a destination-based sales tax state. Still others like Texas and Minnesota are actively expanding service taxability.

In almost every case the person. The Mission of the New Mexico Judiciary is to protect the rights and liberties of the people of New Mexico guaranteed by the Constitution and laws of the State. The New Mexico Department of Workforce Solutions is a World-Class market-driven workforce delivery system that prepares New Mexico job seekers to meet current and emerging needs of.

It administers more than 35 tax. The business almost always passes the tax onto the consumer either as a. New forms to provide this information are now available on our website.

Departments and Agencies. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. New Mexico Judiciary Branch.

New Mexico Sales Tax Guide. Delaware Hawaii New Mexico and South Dakota tax most services. 1 day agoA New Mexico Hearing Officer found that Gross Receipts Tax does not apply to a taxpayers markup for services performed outside New Mexico but the taxpayers.

The Taxation and Revenue Department serves the State of New Mexico by providing fair and efficient tax and motor vehicle services. The Gross Receipts tax rate now is calculated based on where the goods or products of. Rapid Tax Of New Mexico is a full service income tax preparation business serving individuals and small businesses.

Instead of collecting a sales tax New Mexico collects a gross receipts tax. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of. After this date Business Services will no longer.

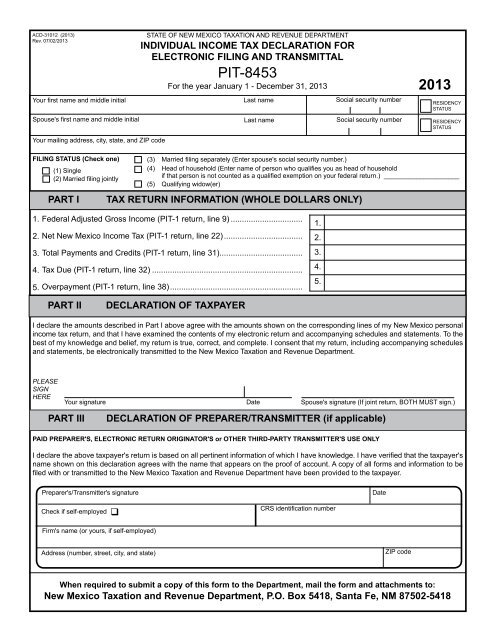

Businesses that sell services across. New Mexico does not have a sales tax. 9 The individual income tax rates are listed in the table below.

Personal income tax rates for New Mexico range from 17 to 49 within four income brackets. This page describes the taxability of. It has a gross receipts tax instead.

Compensating tax Section 7-9-7 NMSA 1978 is an excise tax imposed on persons using tangible property services licenses or franchises in New MexicoThis tax is sometimes called a use. New Mexico Taxpayer Access Point allows taxpayers to file their taxes make payments check refund statuses manage their tax accounts register new businesses and more. New Mexico Administrative Code.

Our office will accept the old forms until July 15 2021.

Bill Proposes Tax Credit For People Recently Moved To New Mexico Krqe News 13

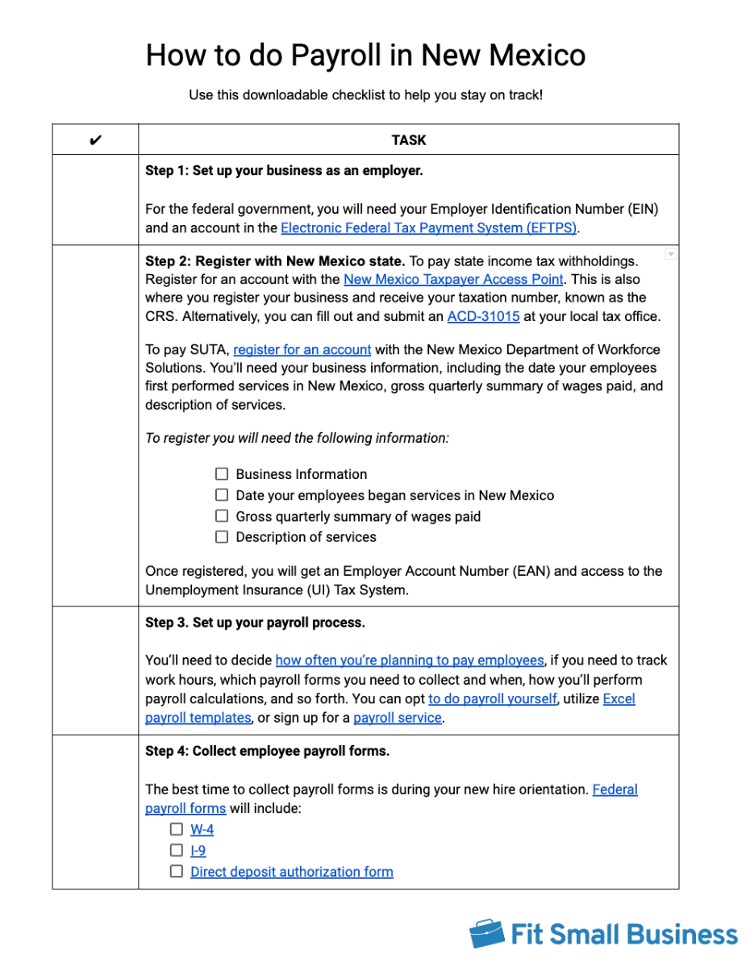

How To Do Payroll In New Mexico Everything Small Business Owners Must Know

New Mexico Taxation And Revenue Facebook

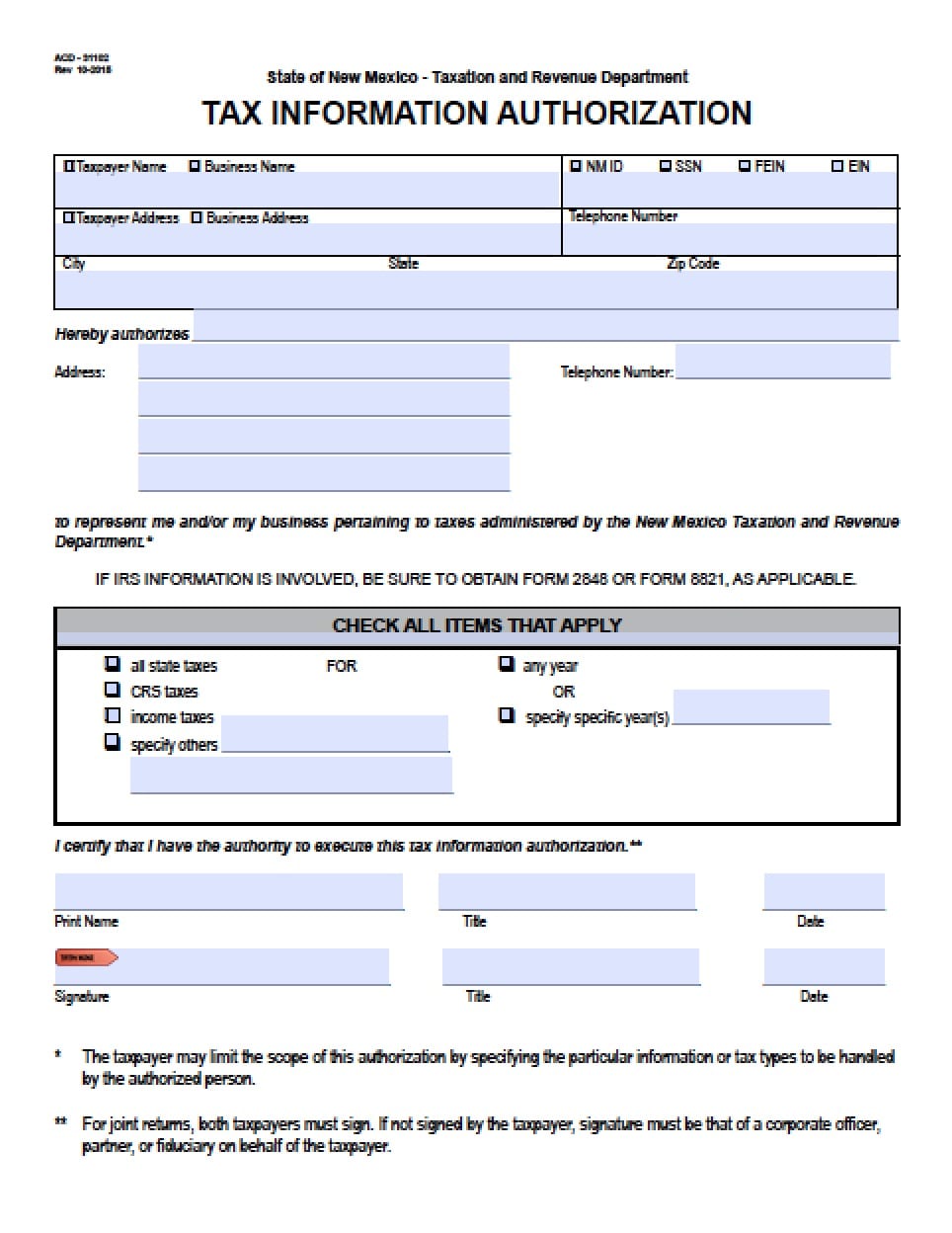

Form Taxation And Revenue Department State Of New Mexico

Aarp Foundation Free Tax Aide Alamogordo Nm

Like Everything Else 2020 My Tax Return Has Turned Into A Dumpster Fire For The Life Of Me I Can T Figure Out What S Going On With My State Returns R Tax

Gross Receipts Location Code And Tax Rate Map Governments

New Mexico Paycheck Calculator Smartasset

How To File And Pay Sales Tax In New Mexico Taxvalet

Assessor S Office San Juan County Nm

File New Mexico Taxes Get Refund Faster E File Com

Home New Mexico Mortgage Finance Authority

New Mexico Among States Cutting Corporate Income Tax Rates In 2017 Albuquerque Business First

A Guide To New Mexico S Tax System New Mexico Voices For Children

A Guide To New Mexico S Tax System New Mexico Voices For Children

Taxpayer Problem Solving Day Approaches Rio Rancho Observer

New Mexico Tax Power Of Attorney Form Power Of Attorney Power Of Attorney